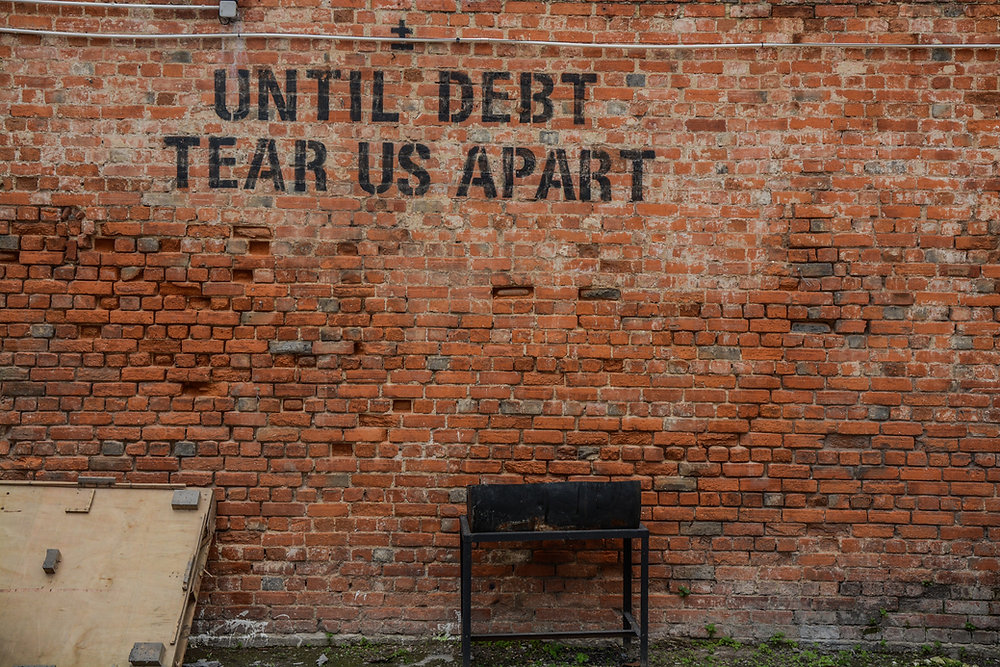

A liability is defined as a debt or obligation.

In finance, we use this term to describe financial obligations or debts that a company or individual owes to another party. Liabilities can be present in the form of goods, services, or monetary sums expected to be paid off to avoid financial consequences in the future.

Let's look at a prime example of a liability in our day-to-day lives: credit card debt. When you use a credit card to make purchases, you borrow money from the credit card company with the promise to pay it back later. If you don't pay off the full amount each month, you may have to pay interest on the remaining balance. This borrowed money, or debt, is considered a liability because it represents an obligation to pay back what you owe in the future.

There are two main types of liabilities in the finance world: current and long-term.

Current liabilities represent debts or obligations that are due within one year. For example, short-term loans can be seen as a current liability. People should be very careful with these types of liabilities; failure to pay off these short-term debts or obligations may lead to financial consequences

Long-term liabilities represent debts or obligations that are to be paid to creditors beyond a one-year time frame. A good example of a long-term liability is a mortgage loan. When you take out a mortgage loan, you borrow money from a lender, such as a bank or a mortgage company, to buy property. The property itself serves as collateral for the loan, meaning the lender can take possession of the property if you fail to repay the loan according to the agreed terms. These loans can span over 12 months, including several years depending on the loan.

All in all, understanding how liabilities work in the finance world can save you money and profit. By being aware of the different types of liabilities and their implications, you can make informed decisions, plan effectively, and ensure a healthier financial future.